Last year, the global economic outlook was marked by a sharp escalation of geopolitical uncertainty and major policy shocks. In April, the US administration under President Trump abruptly announced sweeping tariffs, centred on a 10% baseline levy on imports, with even higher rates on selected countries. This represented a massive negative shock for trade, as the US accounts for 26% of the global economy, and was previously predominantly open to trade with an average tariff rate of less than 2%. As a result, the outlook for international trade, as well as for the global economy, began to deteriorate sharply, on fears of the impact of massive supply-chain disruptions and potentially escalating trade wars. Similar worries resurfaced this year as the US continued to signal the use of tariffs as an “economic weapon” to achieve broader foreign policy objectives.

However, rising US protectionism did not trigger widespread tariff wars as was initially feared. In fact, even as the US increased the burden for its trade partners, and against a backdrop of trade fragmentation, the rest of the world has continued to move towards deeper integration. Most major economies continue to view trade as essential to their growth models and are actively pursuing deeper integration via new or deeper trade agreements.

Previously delayed trade negotiations have regained momentum, as countries seek further diversification of their partners to mitigate the fallout of US protectionism. Among these initiatives, the European Union-Mercosur trade deal returned to the centre stage, after 25 years of arduous negotiations. Despite large potential gains, the deal had been delayed over resistance to the Mercosur’s agricultural market access to the EU, and environmental governance in the South American bloc. However, the balance of strategic priorities has shifted, as growing geopolitical fragmentation and trade risks have increased pressure on the EU to accelerate trade integration.

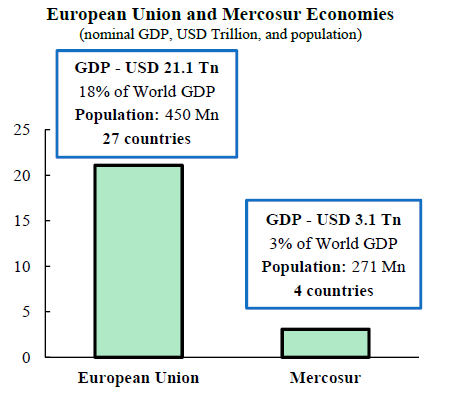

European Commission President Ursula von der Leyen finally signed the agreement last month with the South American Mercosur bloc, encompassing Argentina, Brazil, Paraguay, and Uruguay. The deal could create one of the largest free trade areas in the world, with 31 countries, 721 million people, and close to 21% of global GDP. However, the deal still faces obstacles, with a narrow majority in the Parliament referring the agreement to the EU Court of Justice (EUCJ). The EUCJ could take up to 2 years to determine whether it is compatible with European law. In the meantime, the European Commission can implement a provisional application of the treaty, until hurdles for the full implementation are passed.

Despite the expected resistance, the potential economic gains are considerable. The agreement provides for the gradual elimination of tariffs on around 92% of bilateral trade. Transition periods extend up to 15 years for the most sensitive products. Nevertheless, progress on this landmark accord would be an encouraging sign. Even as the world adjusts to a more protectionist US, the outlook on trade policy across the world is being mitigated by non-US initiatives. In this article, we discuss the key economic aspects of the Mercosur-European Union (EU) trade agreement.

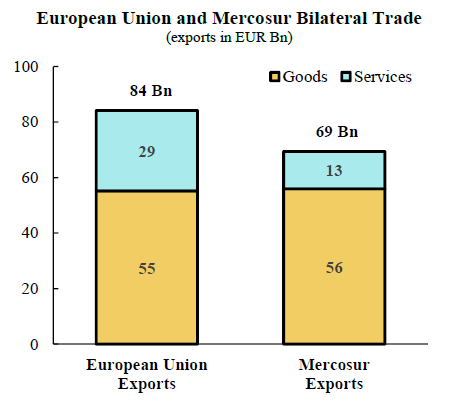

First, prospective gains in trade volumes are significant, especially for the smaller and relatively less trade-integrated Mercosur. Total bilateral trade in goods and services is close to EUR 153 Bn per year, which represents less than 1% of total combined GDP. In comparison, this is only a fraction of the 3.5% figure for bilateral trade in goods and services between the US and the EU, indicating a large margin for increasing bilateral flows.

First, prospective gains in trade volumes are significant, especially for the smaller and relatively less trade-integrated Mercosur. Total bilateral trade in goods and services is close to EUR 153 Bn per year, which represents less than 1% of total combined GDP. In comparison, this is only a fraction of the 3.5% figure for bilateral trade in goods and services between the US and the EU, indicating a large margin for increasing bilateral flows.

For Mercosur, the agreement offers improved access to one of the world’s largest and highest-income markets. The phased elimination of tariffs on the vast majority of exports to the EU is expected to support agricultural and agri-industrial exports, as well as export diversification towards manufacturing. For the EU, the deal will expand access to a large South American market with over 271 million consumers, lowering trade costs for industrial goods, machinery, chemicals, and services, while providing improved access to valuable natural resources. Additionally, it is considered an important geopolitical win, in times of stern competition with China and the US.

For Mercosur, the agreement offers improved access to one of the world’s largest and highest-income markets. The phased elimination of tariffs on the vast majority of exports to the EU is expected to support agricultural and agri-industrial exports, as well as export diversification towards manufacturing. For the EU, the deal will expand access to a large South American market with over 271 million consumers, lowering trade costs for industrial goods, machinery, chemicals, and services, while providing improved access to valuable natural resources. Additionally, it is considered an important geopolitical win, in times of stern competition with China and the US.

Second, the agreement will lead to larger investment flows and therefore growth, particularly for the less-developed Mercosur. EU firms already account for roughly 35–45% of the total FDI stock in Mercosur, making the EU the largest investor bloc. The total is equivalent to more than EUR 390 Bn, with strong exposure to manufacturing, energy, and financial services. The new agreement will provide improved market access and legal certainty, supporting additional greenfield investments. In a reasonable scenario, the EU FDI stock could grow by 10-20% over the next 10 years, which could generate a boost to GDP of over 0.6%. For the EU, Mercosur countries hold significant potential in renewable energies and critical raw materials, creating opportunities aligned with the EU’s industrial strategies.

All in all, the Mercosur-EU trade agreement offers significant potential economic gains, as well as adds to the initiatives challenging the narrative of increased protectionism. GDP gains, backed by trade and investment flows, are expected to be understandably larger for the less-developed Mercosur. The EU stands to gain through improved market access for its companies, investment opportunities in high-growth sectors, and enhanced diversification of supply chains, particularly in areas related to energy transition and critical raw materials.

Download the PDF version of this weekly commentary in English or عربي